Nearly all states in the US require car owners to carry car insurance for the automotive registered in their name. And the consequences of not having a policy vary from each state, but all of them are not light whatsoever. But despite this, many are still uninsured. So, what happens if you don’t have car insurance and get pulled over?

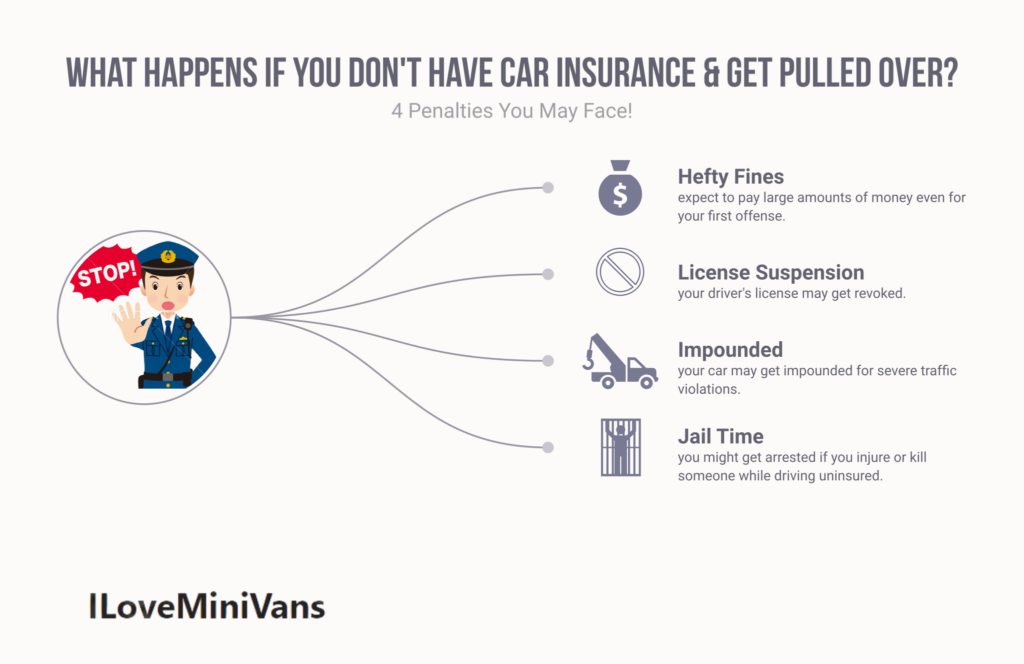

From hefty fines to jail time, there are many consequences you may face when caught driving with car insurance. Let’s discuss each penalty in-depth below—and what you can do to avoid them.

Do You Really Need Car Insurance to Drive?

Having car insurance won’t only protect you financially, but it will also help you stay on good terms with the law. After all, nearly all states, except for New Hampshire, require car owners to have a policy for the vehicles under their names. And if you’ve gotten into an accident without being insured, expect to face penalties.

Although the amount of car insurance depends on each state, here are the general policy requirements for all:

- Property damage liability. Your car insurance policy must cover damage to other parties’ personal property, such as vehicles or fences. It protects you if you ever get into an accident or collision, covering anywhere from $10,000 to $25,000.

- Bodily injury liability. Your coverage should also cover medical fees for injuries caused by other drivers in other vehicles. The plan can cover anywhere from $10,000 to $100,000.

Other states may ask for policies such as med pay, personal injury protection, or uninsured motorist coverage. Some of these might be mandatory, so it’s best to check the requirements for your state.

If you don’t have car insurance or let your past policies lapse, getting into a car accident can devastate all parties. After all, vehicle repair and medical costs can cost you anywhere between a couple of thousands to millions of dollars. Aside from that, you may also face jail time if you injure or kill other drivers while being uninsured.

What Happens if You Don’t Have Car Insurance and Get Pulled Over? 4 Penalties You May Face.

✅ If You Don’t Have Car Insurance and Get Pulled Over by Cops, Expect Hefty Fines.

Driving without car insurance can get you into financial trouble like any other illegal activity. Getting caught without an auto policy can leave you with hefty fines of up to $5,000 for your first offense. But getting into an accident while being uninsured is another story. Cases like these can quickly rack up tens and thousands of dollars.

Although the fines depend on each state, most will likely be enough to drive most people into massive debt—or bankruptcy. And almost all expenses will be on you if the police prove you are at fault. Or worse, the other driver involved in the accident might sue you, forcing you to pay more than the initial costs.

✅ Temporary Driver’s License Suspension.

If the police catch you driving without insurance, they can suspend your driver’s license in addition to giving you a ticket. The length of suspension varies for your offense and in each state.

Some states may end your license suspension early if you show proof of your car insurance or file for an SR-22. On the other hand, some allow the local court or DMV office to suspend your license for a set period.

Aside from that, the consequences leading to suspension also differ between states. Some may revoke your driver’s license if you get caught without financial responsibilities in a traffic incident. Meanwhile, others may suspend your driver’s license for something as light as going past the red light and require you to show proof of your policy within 24 hours.

For instance, license suspension can go for as long as 60 days in Massachusetts. On the other hand, states like Winsconsin suspend driver’s licenses for driving without insurance indefinitely. They can hold your license until you show proof of your policy or file for an SR-22.

✅ Your Car Might Get Impounded/Towed, and You May Lose Your License + Registration.

If the authorities catch you driving without car insurance, your vehicle might get impounded, especially when you get into an accident. Aside from that, your local court might also order to revoke your driver’s license and registration.

You can only retrieve all those if you submit valid proof of your car insurance to your local DMV office, usually an SR-22. Aside from that, some states will also require extra reinstatement and processing fees before getting your car, license, and registration back.

For instance, if you don’t submit evidence of an auto policy within 24 hours of being cited, your impounded vehicle might be stripped of its registration. On the other hand, some might make a mandatory order of having your car impounded for a month, whereas you have no choice but to wait.

✅ What Happens if you Don’t Have Car Insurance and Get Into An Accident? Jail Time or Prison Sentence.

Since most states deem driving without car insurance a crime, you might get jail time or a prison sentence, depending on how severe your offense is. Usually, states only order jail time if the driver got into an accident where another individual got injured or killed.

However, repeat offenders will get higher fines and stricter penalties even without anyone getting injured or killed.

Generally, driving without car insurance can let you face jail time for a few days or two weeks. On the other hand, some states like Michigan order heavy prison sentences of up to a year. Besides this, some charges might also come with extra fines and fees to add more salt to the injury.

How Do the Police Catch Uninsured Drivers?

Authorities use a few different techniques to find drivers without car insurance. And as technology improves, officers now have more resources than ever before! Below are some of the ways the police catch uninsured drivers on the road:

Authorities May Pull You Over For Traffic Violations.

One of the most common ways police catch uninsured drivers is by pulling them over for a traffic violation. You need to provide your driver’s license, car registration, and proof of car insurance when you get pulled over. It’s an easy way for the officers to confirm if the driver has the required insurance coverage or not.

Moreover, don’t even think about using fake documents as the police can contact the back of the insurance card to see if it’s valid or not. Aside from that, keep in mind that not having car insurance coverage is different from not having “proof” of a policy.

If you are signed up for an insurance policy but didn’t manage to bring your documents with you, you’ll likely only suffer a fine. Plus, you can show your proof of car insurance to void these charges against you.

On the other hand, having an expired auto policy or not having car insurance will land you in more significant mines. You’ll likely need to pay a massive fine and might have your driver’s license and car registration revoked.

The Police May Set Up Traditional Vehicle Checkpoints and Pull Over Vehicles.

Although uncommon nowadays, conventional vehicle checkpoints still exist. Some officers still set up checkpoints where they pull over drivers to ask for their driver’s license, car registration, and proof of coverage.

If you don’t give valid proof of coverage at the checkpoint, the officers can legally subject you to a hefty fine. Or worse, your vehicle might get towed if you don’t have insurance.

Some Officers Set Up an Automatic License Plate Recognition (ALPR) System.

On the topic of “what happens if you don’t have car insurance and get pulled over by the cops,” many can get through different drivers thanks to the ALPR system. This latest technology helps officers quickly find drivers without valid car insurance.

Authorities can determine whether a vehicle is insured or not by running its license plate number to the ALPR system.

Check Data From Local Insurance Companies.

Many states require insurance firms to share their database of policy numbers alongside the license plate numbers of their clients with the authorities.

This practice makes matching registered and insured vehicles to their specific policy plans more seamless. Plus, it makes it more challenging for drivers without car insurance to present fake info to the cops if they get pulled over.

Unfortunately, most police forces don’t have on-demand access to insurers’ databases in practice. That means officers still need to contact these insurance firms manually to confirm all information checks out.

How Can I Avoid Fines and Penalties for Driving Without Car Insurance?

Driving uninsured will never be a wise decision, and there’s no legal way to avoid penalties without having car insurance. So, to not get into hot water with the law, here are some things you can do:

⭕ Buy Car Insurance and Pay the Bill On Time.

If you’re currently uninsured or your previous policy has already ended, buy at least the minimum insurance coverage required in your state before going back on the road. Also, remember always to pay the bill on time to avoid issues and keep your coverage.

Unfortunately, some insurance firms aren’t lenient and have strict grace periods, so always check with your insurer if you’re late on any required payments.

⭕ Always Carry Your Proof of Insurance When Driving to Avoid Getting in Trouble When Pulled Over.

Once you get your car insurance, always carry proof of coverage when on the road. After all, some states issue fines to those behind the wheel without proof of insurance. So, even if you’re insured, you might still get into trouble if you don’t have evidence when driving.

Luckily, most states provide a brief grace period, so you can show your proof of insurance to your local police department before they can issue a ticket to you. Usually, you have around 24 hours to a few days to have everything settled, keeping your name clean.

But either way, fines for failure to show proof of coverage are usually lighter than those driving without insurance. As I mentioned earlier, what happens if you don’t have car insurance and get pulled over are the following:

- Financial consequences, including tickets or additional fees.

- Your vehicle might get impounded.

- Temporary license suspension.

- The DMV may revoke your car registration.

- Jail time or prison sentence.

Punishments for driving without car insurance depend on several infractions or damages you’ve done and your current state.

On top of those penalties mentioned, you might also be ordered to pay extra processing or assessment fees. So, it will be a hassle not to show proof of insurance and incredibly costly.

⭕ If You Want to Change Insurers, Inform Your Current One First.

If you find a better deal for a car insurance policy from another firm, before you change, inform your current one first. After all, you might fall victim to the insurance gap. So, confirm that your latest policy will be in effect as soon as your previous one ends.

Aside from that, if you no longer want auto coverage, notify your present insurer. After all, stopping payments may lead to late penalties, forcing you to pay what you don’t owe. Plus, it can taint your record, showing you’ve stopped paying for your car insurance.

Getting Insured: How to Pick the Best Car Insurance Policy?

It can be challenging to find the right car insurance for your car, state, finances, and unique situation. Either way, here are some of my foolproof tips to help you pinpoint the best policy for your ride:

❗Inquire About Discounts for their Car Insurance Policies.

Discounts are more common in insurance policies than you’d think, and here are some of the people insurers provide discounts to:

- Previous and current military members.

- Car owners with positive payment history.

- Individuals with a decent driving history.

- Students with good grades.

- People with a good credit score.

Aside from that, many insurers also offer low-mileage use discounts nowadays due to people staying at home. So, if you’ve been driving less recently, ask if you can adjust your mileage use and snag a discount.

❗Shop Around for Coverage.

Choose your coverage carefully to avoid the consequences of not having car insurance and getting pulled over by cops. No matter how time-consuming it may be, it’s worthwhile to make the necessary phone calls and research to find the best coverage and

deals!

Each insurer has a unique pricing formula, meaning some will inevitably provide better rates than others. Moreover, many offer discounts for various coverage. For instance, some firms offer a 25% discount for clients who bundle home and car insurance together.

Frequently Asked Questions

Q: What happens if you don’t have car insurance and get pulled over by the cops?

A: The penalty varies per state, but all are constantly harsh. Some punishments include losing your driver’s license or having your car impounded for weeks. Meanwhile, some ask you to pay hundreds in fines. But penalties are worse if you get into an accident or other traffic violations, such as speeding or DUI.

Q: Is it possible to drive without car insurance?

A: It’s primarily illegal to drive without car insurance. All states require car owners to get a policy for their vehicles or any other document stating their financial responsibility to own a car and drive it in public. So, like how you can get into hot water with the law while using your phone at a red light, you might get arrested for driving while uninsured.

Q: How would the police know if a car is uninsured?

A: Officers usually ask car owners if they have car insurance by asking for an insurance ID. Meanwhile, some cops check if you have a policy registered with the DMV. After all, most states require insurers to report active insurance plans to the DMV. So, it doesn’t take a detective to figure out if you have car insurance or not.

Q: What happens if my car insurance lapses?

A: If you leave your car insurance to lapse, you won’t have the coverage to protect you in case of an accident or when your vehicle gets stolen or damaged. Aside from that, if you get caught driving without being insured, the police can legally charge you. And that often results in hefty fines, license suspension, and some jail time, depending on your state.

Q: What happens if you don’t have car insurance in general?

A: If you get into an accident, and you’re the one who caused it, you need to pay for the damages out of pocket. You’ll have to pay for the hospital bill and car repair costs. And the fees can add up pretty fast. So, it’s best to sign up for a car insurance policy to protect yourself financially.

Final Words

What happens if you don’t have car insurance and get pulled over? The cops will only likely charge you a hefty fine if it’s your first time. Meanwhile, you may risk losing your license or vehicle and even spend some time in jail if it’s not. Regardless, you can see how crucial it is to have car insurance. It not only protects you financially but also from the justice system. So, get insured today!